You’re Carrying the Weight. We’re Here to Help.

Support your parents. Protect their legacy. Build your own financial futurewithout doing it all alone.

You’re Carrying the Weight. We’re Here to Help.

Support your parents. Protect their legacy. Build your own financial futurewithout doing it all alone.

You’re the caregiver, the

planner, and the backup

plan.

Often called the “sandwich generation,” you’re supporting aging parents while raising kids or helping grandkids. You’re caught in the middle trying to care for your family above you, beside you, and below you.

Adult children are often financially strained paying for parents' care, funding college, managing household expenses, and still trying to save for retirement.

We help this generation:

Prepare for their parents

Empower any future inheritance they may

Protect their own families now

And secure a legacy for the generation coming after them

You don’t want your parents to feel like a burden. And you don’t want to become one either. That’s why Dominion created Wealth Bridge™ a support system designed to carry the weight with you.

You’re the caregiver, the planner, and the backup plan.

Often called the “sandwich generation,” you’re supporting aging parents while raising kids or helping grandkids. You’re caught in the middle trying to care for your family above you, beside you, and below you.

Adult children are often financially strained paying for parents' care, funding college, managing household expenses, and still trying to save for retirement.

We help this generation:

Prepare for their parents

Empower any future inheritance they may

Protect their own families now

And secure a legacy for the generation coming after them

You don’t want your parents to feel like a burden. And you don’t want to become one either. That’s why Dominion created Wealth Bridge™ a support system designed to carry the weight with you.

Guidance. Protection.

Relief.

Reviewing your parents’ life insurance or burial plans

Securing Final Expense coverage before it’s too late

Understanding Medicare, Medicaid, and long-term care costs

Planning for funeral and estate expenses

Clarifying legal documents (wills, POAs, beneficiaries)

Making sure YOU have a protection plan in place too

Reviewing or rolling over retirement accounts for long-term security

Guidance. Protection. Relief.

Reviewing your parents’ life insurance or burial plans

Securing Final Expense coverage before it’s too late

Understanding Medicare, Medicaid, and long-term care costs

Planning for funeral and estate expenses

Clarifying legal documents (wills, POAs, beneficiaries)

Making sure YOU have a protection plan in place too

Reviewing or rolling over retirement accounts for long-term security

Testimonials

Danielle helped her mom, Gloria, lock in her final expense and estate plan with Dominion.

Weeks later, Gloria had a health event and Danielle was prepared.

Because of that experience, she started her own policy, added long-term

care coverage, and began building her financial future with clarity.

Danielle helped her mom, Gloria, lock in her final expense and estate plan with Dominion. Weeks later, Gloria had a health event and Danielle was prepared.

Because of that experience, she started her own policy, added long-term care coverage, and began building her financial future with clarity.

You’re Not Just Their Child, You’re

Their Support System

Adult children caring for one or both aging parents

Families worried about medical or funeral costs

Siblings unsure who’s “in charge” when a crisis happens

Grandchildren stepping up for grandparents

Spouses or in-laws trying to help but unsure how

Anyone juggling legacy, caregiving, financial responsibility, and retirement planning

You’re Not Just Their Child, You’re

Their Support System

Adult children caring for one or both aging parents

Families worried about medical or funeral costs

Siblings unsure who’s “in charge” when a crisis happens

Grandchildren stepping up for grandparents

Spouses or in-laws trying to help but unsure how

Anyone juggling legacy, caregiving, financial responsibility, and retirement planning

Family First. Strategy

Always.

We understand the emotional and financial weight you carry. That’s why we treat every plan like a family plan.

You’ll get guidance, clarity, and a support system that works not just for your parents, but for you.

The Dominion Difference: We don’t pretend to do everything but we make sure you’re supported at every step. That’s why we partner with vetted experts in financial coaching and estate law so you always have the right guide for every season.

Family First. Strategy Always.

We understand the emotional and financial weight you carry. That’s why we treat every plan like a family plan.

You’ll get guidance, clarity, and a support system that works not just for your parents, but for you.

The Dominion Difference: We don’t pretend to do everything but we make sure you’re supported at every step. That’s why we partner with vetted experts in financial coaching and estate law so you always have the right guide for every season.

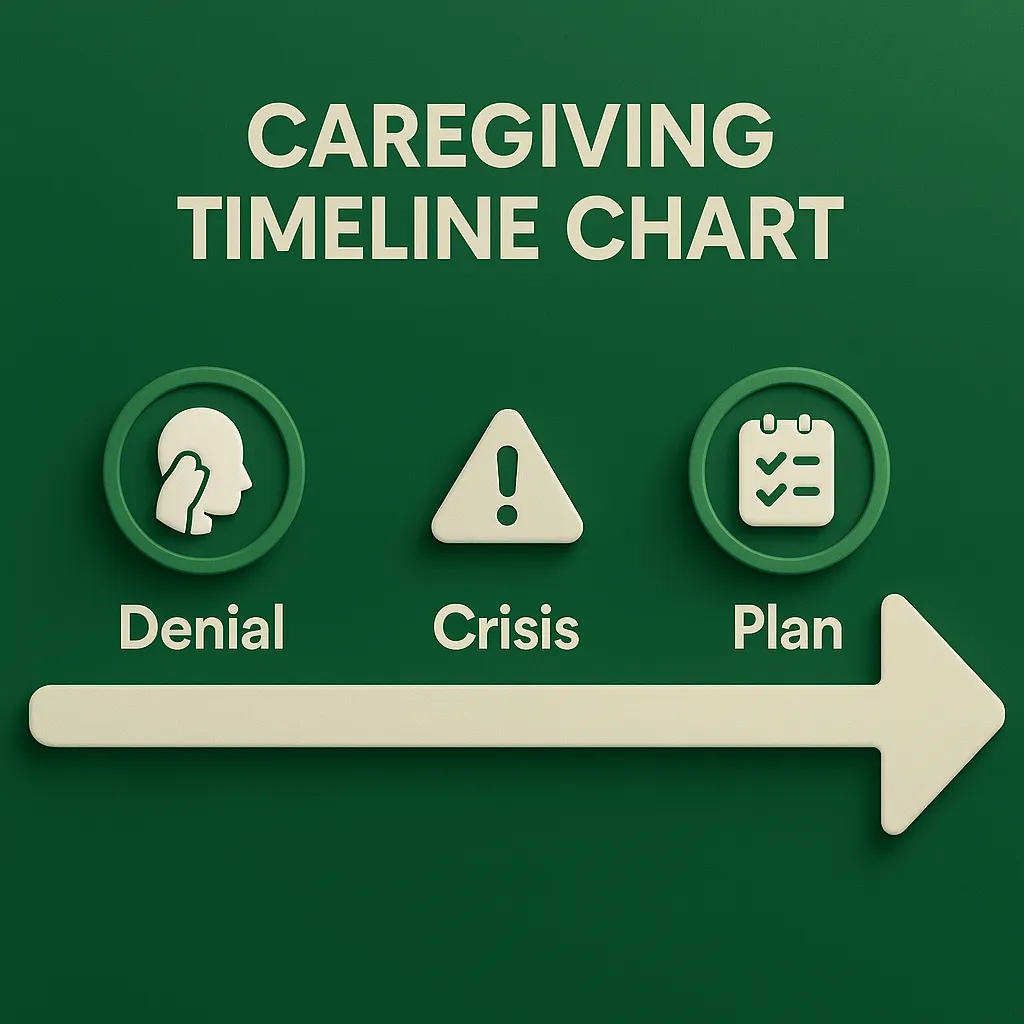

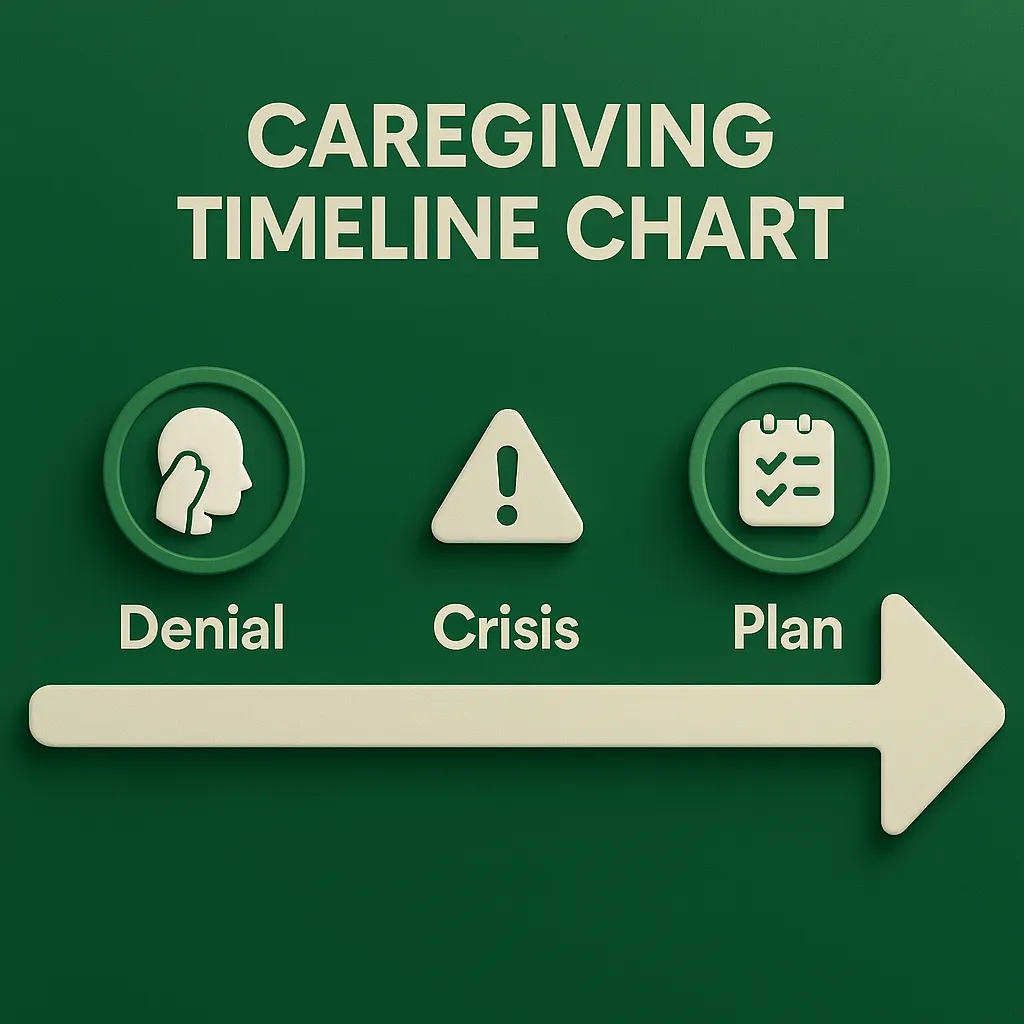

Don’t Wait Until You’re Forced to Figure It Out

We’ll help you prepare, protect, and plan so you’re not left scrambling when life changes and

your family never has to carry the burden alone.

Don’t Wait Until You’re Forced to Figure It Out

We’ll help you prepare, protect, and plan so you’re not left scrambling when life changes and your family never has to carry the burden alone.